People First Credit Union Consumer Banking Platform

Designed and implemented comprehensive deposit account workflows for People First Credit Union with membership requirements and integrated services.

Project Overview

Designed, implemented, and launched the end-to-end workflow for People First Credit Union's deposit account products and consumer lending products (apply.peoplefirst.com), including Free Checking, Hometown Heroes Checking, Auto Loan, Personal Loan, and more.

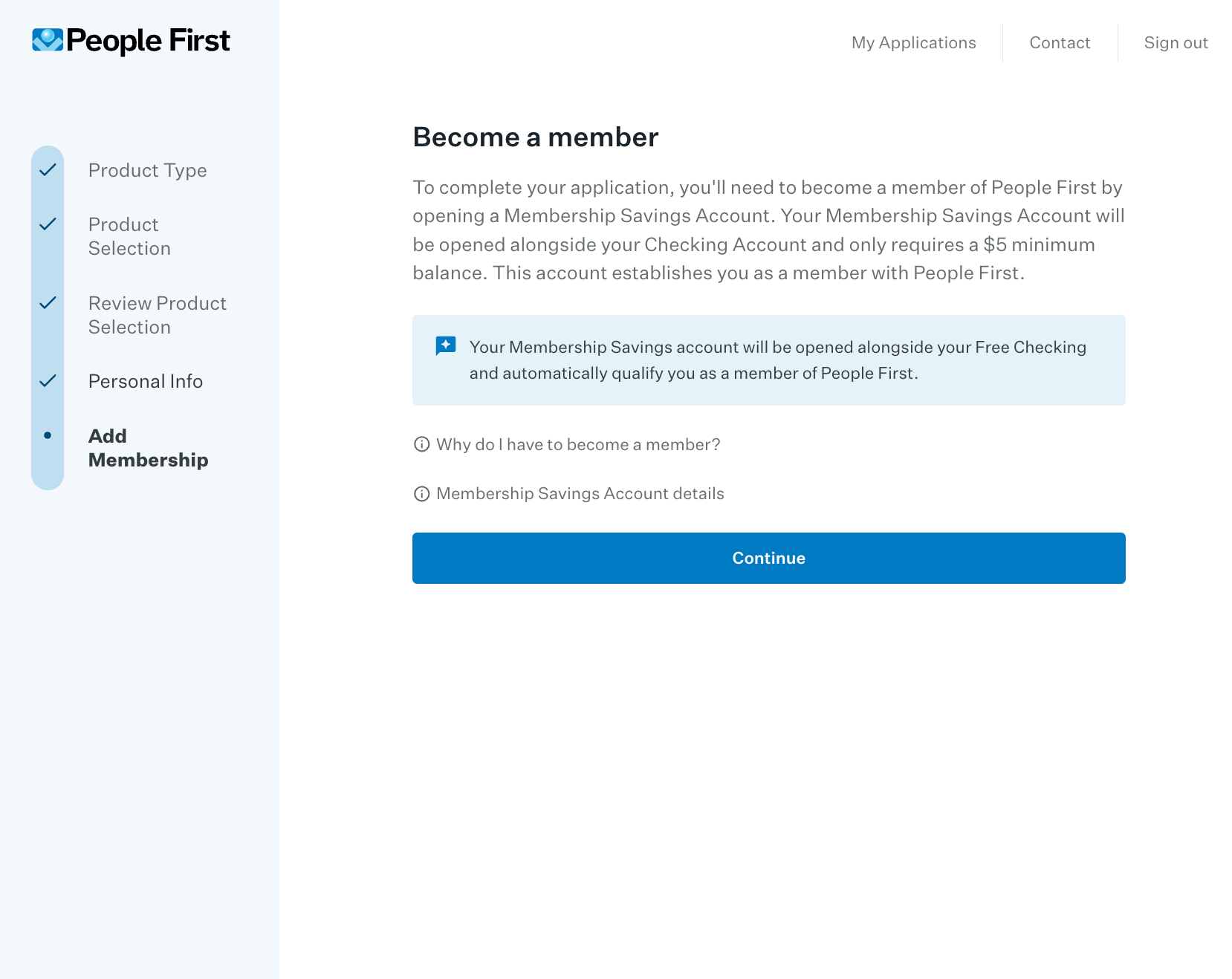

The platform provides seamless integration with existing credit union systems while maintaining high security and compliance standards, including mandatory membership establishment through Membership Savings accounts.

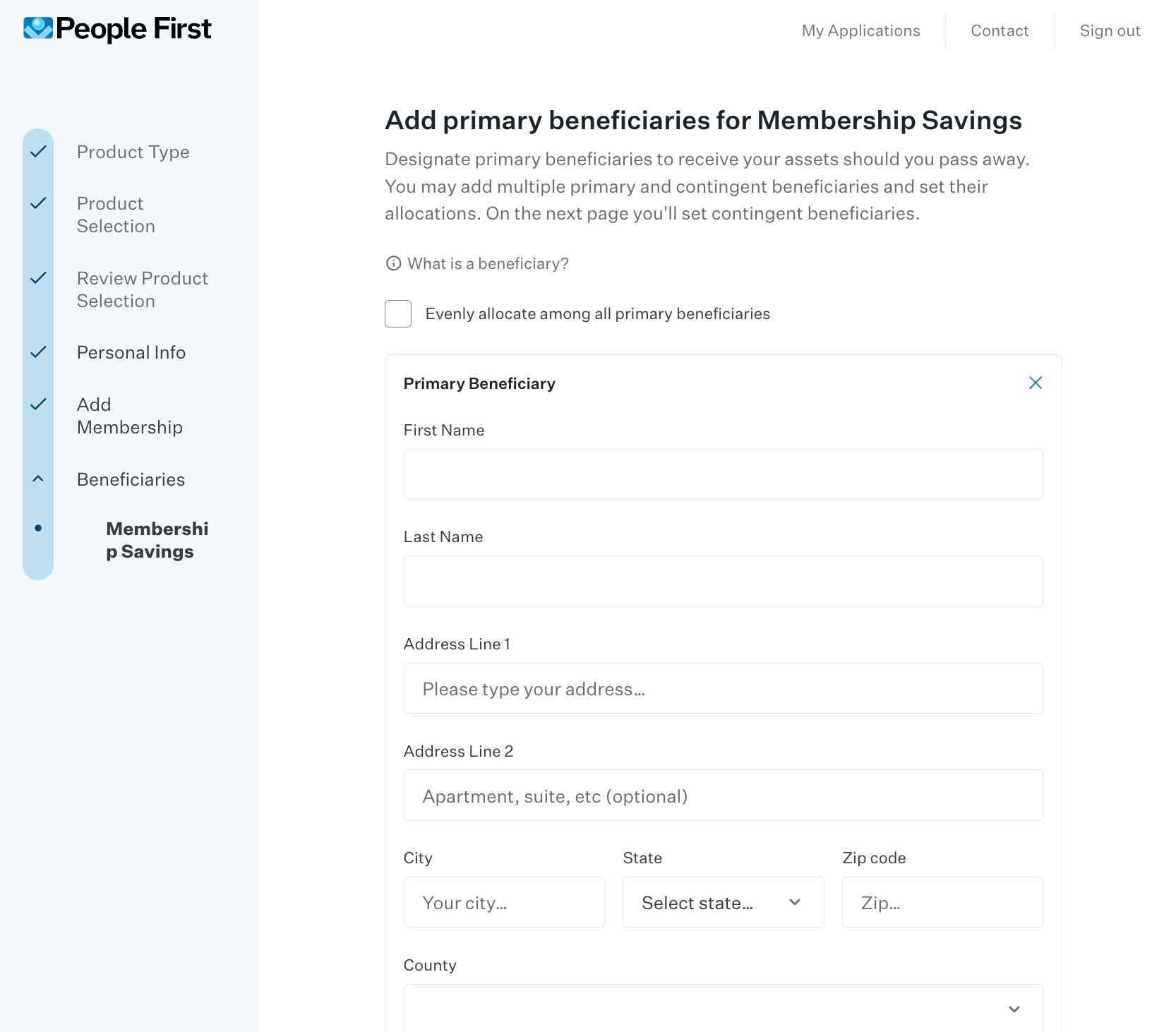

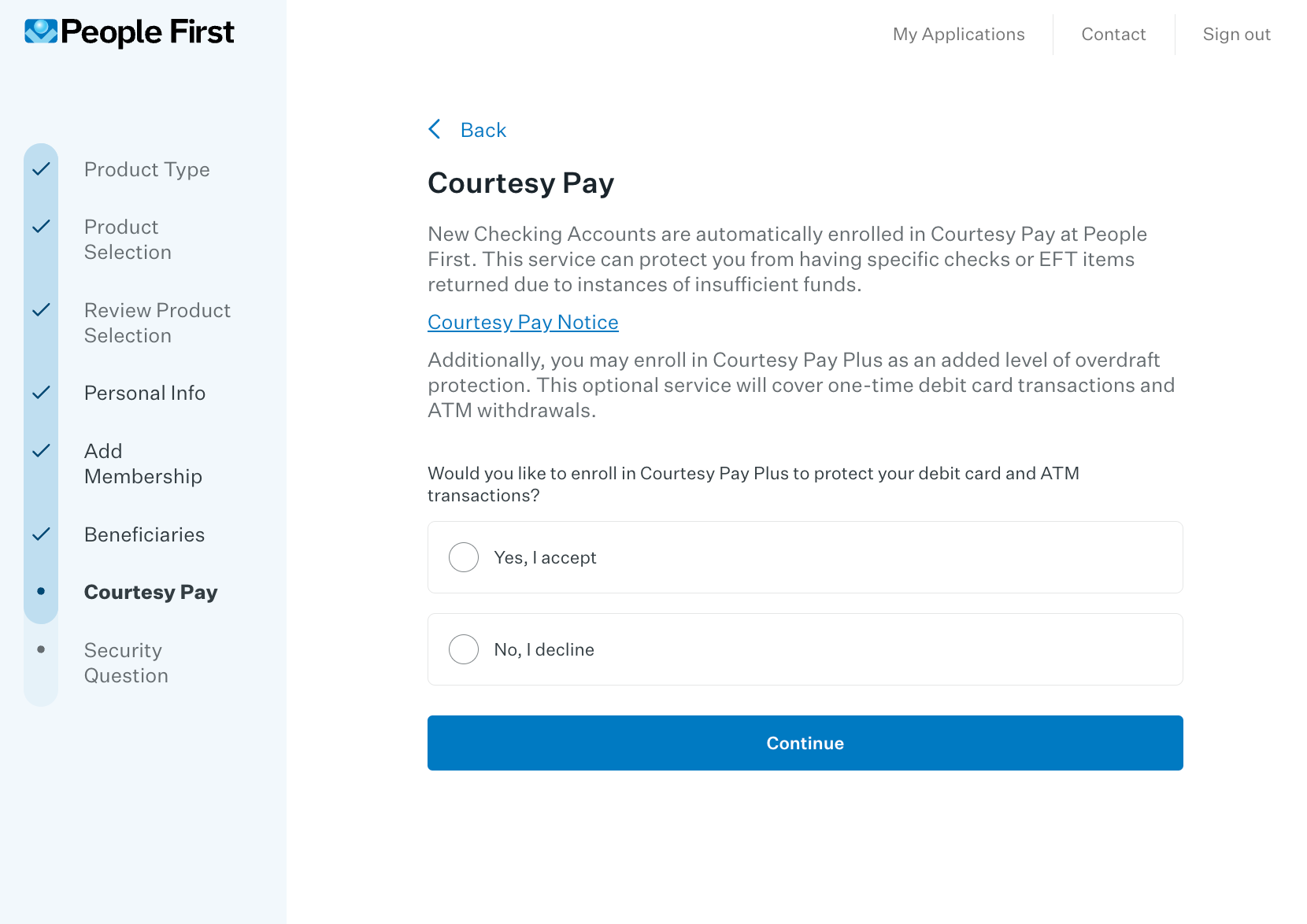

Implemented comprehensive identity verification, beneficiary management, and optional services like Courtesy Pay overdraft protection to create a complete banking onboarding experience.

Key Features

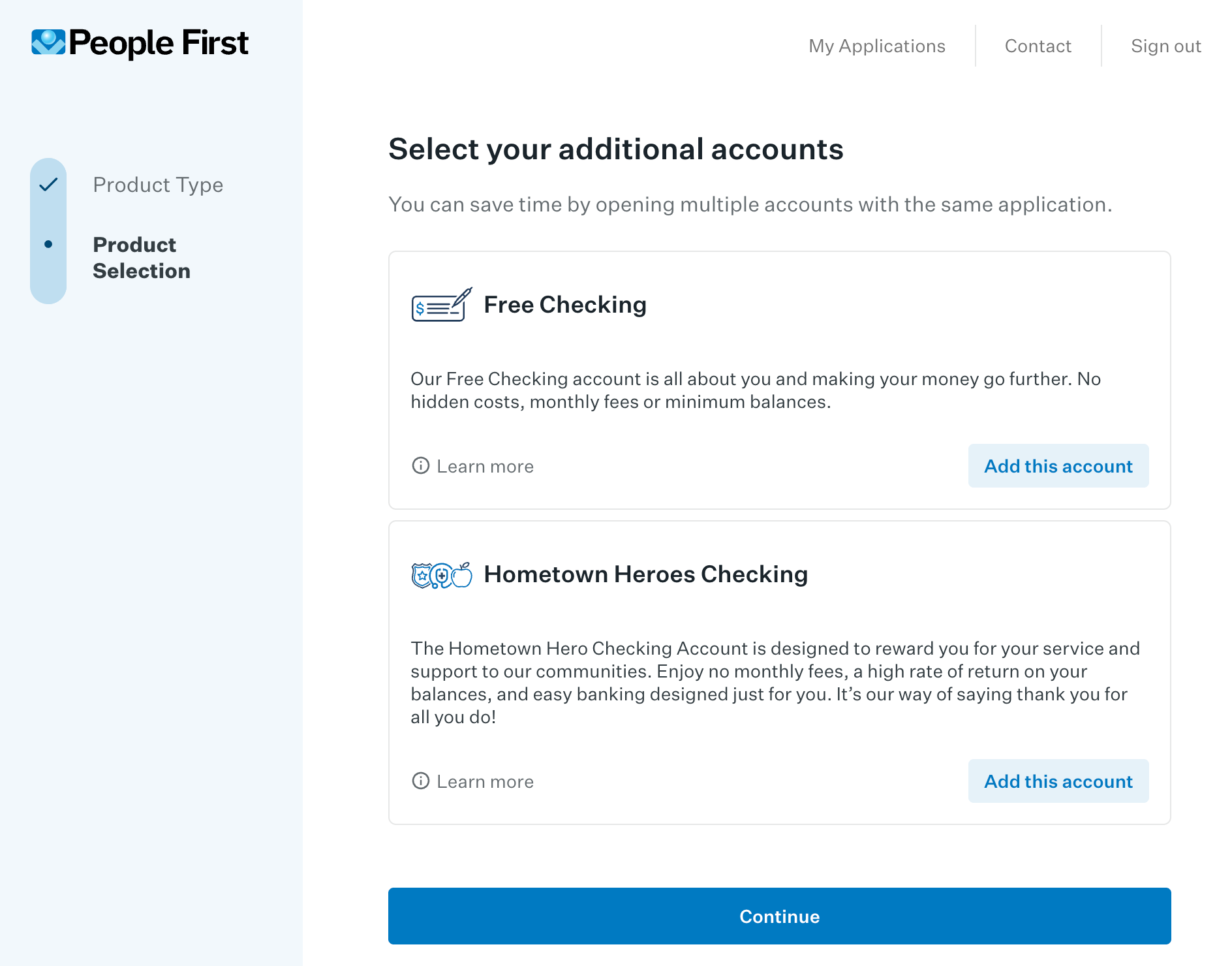

- Multi-account opening with shopping cart functionality

- Custom membership logic and customer lookup built out just for client

- Comprehensive beneficiary management with detailed address collection

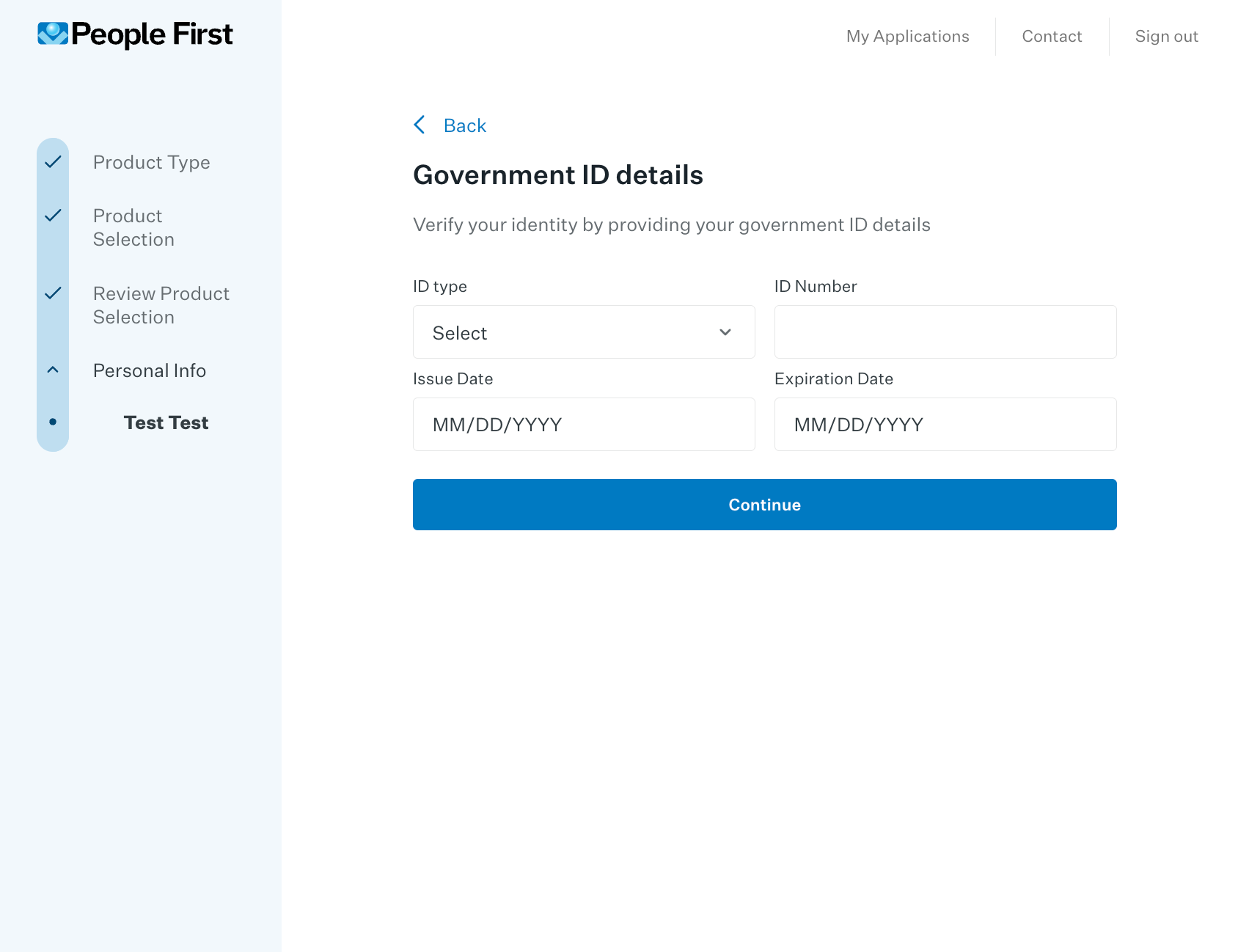

- Identity verification through government ID validation

- Courtesy Pay overdraft protection with multiple coverage options

- JD Power integration and customer prefill via Prove

Technologies Used

Project Gallery

People First Credit Union Deposit Account Platform

Account Selection - Choose between Free Checking and Hometown Heroes Checking with detailed benefits

Identity Verification - Government ID details collection for account opening compliance

Membership Requirement - Mandatory Membership Savings account establishment with $5 minimum balance

Beneficiary Management - Comprehensive primary beneficiary designation with detailed address collection

Courtesy Pay Services - Overdraft protection options for deposit accounts and debit card transactions

Project Details

Client

People First Credit Union

Timeline

12 months (2024-2025)

Role

Implementation Engineer / Product Designer

© 2026 Timothy Rafferty. All rights reserved.